A business line of credit is a flexible reserve of cash. Similar to a personal line of credit, it allows you to access cash whenever you need it. But there are a few more things you need to know before applying for a line of credit. That’s why we cover all the basics so you’ll know what’s best for your business.

What is a business line of credit?

A business line of credit is a predetermined credit limit that can be used whenever you need it. This way you can withdraw money at anytime, until you reach the limit. The good part: you are only charged interest rates on the amount withdrew, not on the entire pre-approved amount.

Besides, a business line of credit is a revolving financing option. This means that once you’ve paid back the amount you withdrew, you can use it again without applying for a new loan. That’s what make a line of credit a valuable financing option for small businesses who need to cover recurring costs, invest in short-term projects, or finance a marketing campaign.

The main benefit of a business line of credit is its flexibility. Because you can freely access cash when you need it, and only pay for what you use, it can be a cheap, cost-efficient way to fund your business and projects.

Secured vs. unsecured?

It’s important to know that most lenders offer two type of lines of credit:

- Secured line of credit

- Unsecured line of credit

While the way they work remain the same, the conditions and requirement change drastically.

Secured business line of credit

A secured business line of credit is generally more appealing because of a higher limit and lower rates. But as the name suggest, these benefits come at a cost. You will need to have collateral. That means that if you’re not able to make repayments in time, the lender will take possession of the collateral to compensate for the difference.

Unsecured business line of credit

On the other side, an unsecured business line of credit doesn’t require you to pledge any collateral. This typically results in higher rates. In addition, it can also be harder to obtain because of higher credit score requirement.

Whether you decide to go for a secured or unsecured line of credit, the way they actually work remains the same.

How does they work?

A line of credit work the same way as a credit card. You have a limit of credit that you can use for any purchase, and you only pay back what you used. Usually, lines of credit offer higher limit, and lower rates (depending on the type as we’ve seen previously).

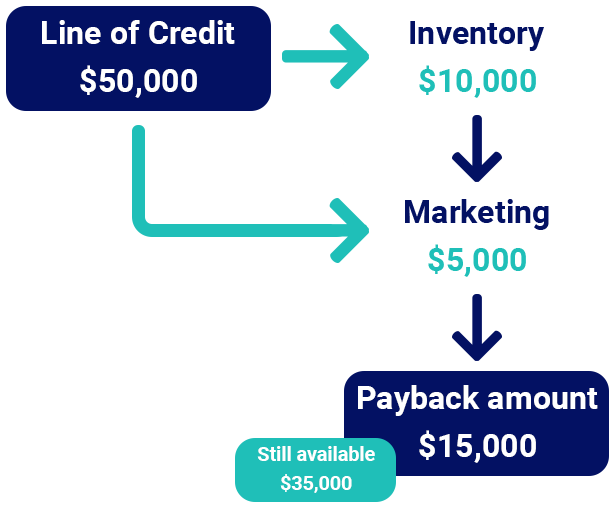

Below is an example below of a $50,000 line of credit used to purchase inventory, and launch a marketing campaign. As you can see, it gives small business the flexibility to invest in different projects, and still have money available to invest in future activities or to face any unforeseen expenses.

Why a business line of credit?

A business line of credit is ideal when you plan to have multiple payments and you don’t know the exact amount. We’ve highlighted some situations in which it’s a perfect fit:

Adjust your cash flow

Cash flow can be a real problem for small businesses. You have to face important seasonal changes, make investment before getting paid, or hire new employees. With a line of credit, you can consolidate your cash flow with an extra reserve of money that is available at anytime.

A line of credit can be an invaluable asset to your business if you can predict your cash flow cycle.

Purchase inventory

Purchasing inventory can be extremely different from one business to another. While a restaurant will need food to cook everyday, a retail shop will buy new collections less frequently. Anyhow, these are recurring costs, hard to predict, that you have no choice to cover upfront.

Invest in marketing

Whether you want to advertise your business or support the launch of a new product or service, marketing is a powerful tool for your small business. But it’s a lot of recurring expenses and sometimes, it can be hard to hard to predict the exact cost. that’s why a line of credit is ideal to cover your marketing activities and power up your ROI.

Business Financing at Just Capital

At Just Capital, we connect Canadian small businesses with the financing they need. Make sure to check all our business financing options, including small business loans and merchant cash advance.