A merchant cash advance is a safe business financing option for every business owners in Canada. Different from a traditional small business loan, a merchant cash advance is a sale of a percentage of your future sales. It’s a flexible financing option that adapt to your business activity.

Besides, the application process is easy and accessible. The approval rate for a merchant cash advance financing is very high and you get the cash on your business account within a few days, sometimes the next day.

When you apply, merchant cash advance companies will mainly take a look at your daily activities, including your daily credit card sales, to evaluate the amount of capital you can access. This way, the company also take a look at seasonality and most importantly, your repayment capacities.

It’s important to keep in mind that rates on a merchant cash advance are generally higher than traditional business loans. This is why you should be mindful of the offer you get and the impact on your potential ROI.

While a merchant cash advance financing is an easy way to access capital, it’s important to understand the ins and outs. With this article, we’ll tell you how it works, how you can repay, and why it’s the right financing solution in different situations.

How does merchant cash advance financing work?

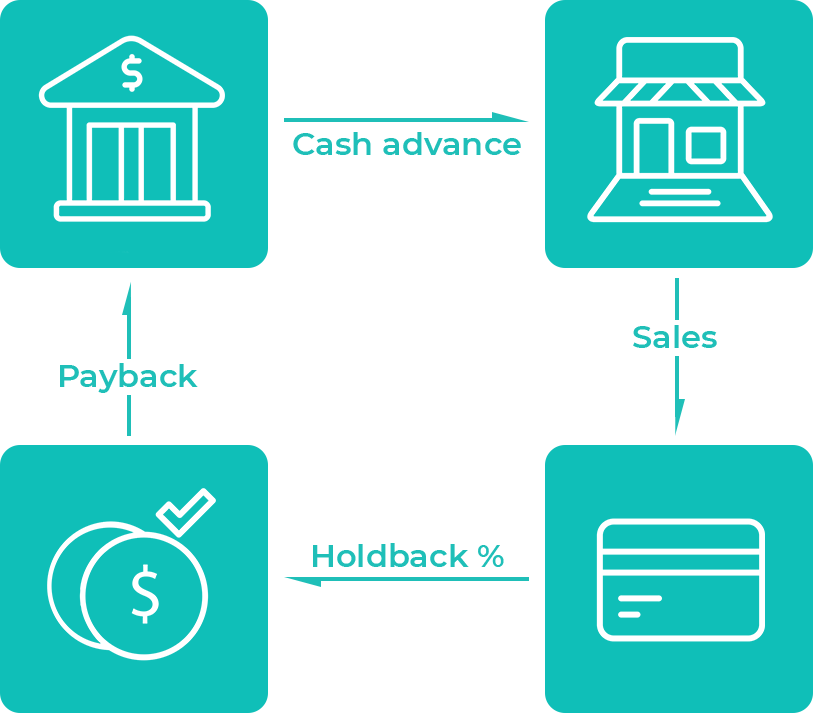

First, you must come to an agreement with your merchant cash advance company about the total amount, the payback amounts, and the percentage of sales used for repayment, also called holdback. Then, the cash is transferred to your business bank account within a few days, and holdbacks begin to take effect.

Each day, a percentage of your daily sales or credit card receipts are held back until you pay your business merchant advance back. This means that, the more credit card sales you do, the faster you repay your cash advance. On the other hand, if there’s a drop in your activity, the amount withheld by the merchant cash advance company will be lower.

This flexibility makes it a safer alternative to traditional small business loan. A fixed monthly payment can become pressing when there’s a dip in sales, due to your business seasonality for example.

If you want to know more, you can read our article: How does business cash advance work [Simple guide with examples]. We dive deeper into the process and illustrate it with lifelike scenarios.

How do I repay my Merchant Cash Advance?

Based on your application and the risk assessed, the merchant cash advance company will calculate a factor rate. This factor rate usually range from 1.2 to 1.5, and determines the total payback amount.

For example, if you get a $20,000 cash advance with a factor rate of 1.30, the total payback amount is equal to $26,000.

When applying for a merchant cash advance financing, it’s important that you understand the difference between the payback amount and the holdback:

- Payback amount: the total amount you need to payback, including the cash advance plus the fees.

- Holdback: the percentage of sales you pay everyday to your business financing provider. For example, a holdback of 18% on a daily credit card sale of a $1,000 means that $180 are withheld and contribute to your total payback amount.

Because your sales are rarely the same, the monthly amounts you’re going to pay will be different. For example, a boom in sales will shorten your repayment period, while a drop will extend it.

Why choosing Merchant Cash Advance financing?

A merchant cash advance financing is a good option when you need a quick access to capital. The merchant cash advance company mostly looks at your daily credit sales to determine if you can repay. This makes the approval process faster, even for business owners with poor credit score.

Besides, because it’s an unsecured financing option, you don’t need collateral. That makes cash advance a safer option for business owners who don’t want to risk personal loss.

Finally, the flexibility is what make it so interesting. Some month can be difficult with a small business loan. If you activity drop, you still have to pay the same amount each month. With a cash advance, you will pay less. This greatly decrease the pressure of monthly payment.

When should you get it?

A merchant cash advance is always a solid option when you need funds quickly or if you’re looking for a financing option that will adapt to seasonal changes. It’s so flexible that you can use the cash for anything that will improve your business.

Buy new equipment: whether you need professional grade kitchen appliances or specialist equipment for your auto shop, the cash advance gives you the money you need.

Cover payroll: a merchant cash advance is a good way to cover recurring expanses such as payroll, or hire new employees that will increase your daily revenues for faster repayment.

Repay existing credit: because it doesn’t impact your credit score, the approval rate is high, and you don’t need collateral, the cash advance is a great way to repay existing credit. It’s a good and safer way to improve your overall credit score.

These are only few examples. Once you receive your money from the merchant cash advance, you can allocate funds to any project that aim to improve your business.

Do you qualify?

There are a few requirements you need to meet before applying for a merchant cash advance at Just Capital:

- Business account: You have at least five deposits a month

- Revenue: You have at least $10,000 of monthly sales

- Years in business: You have been in activity for at least two years

If you meet all three requirements, you can begin our three-steps application today. It’s a simple process that let you access the capital you need in just a few days.

![You are currently viewing Merchant Cash Advance Financing: Everything You Need To Know [the easy way]](https://justcapital.ca/wp-content/uploads/2020/10/merchant-cash-advance-financing.jpg)

![Read more about the article How does Business Cash Advance work? [Simple guide with examples]](https://justcapital.ca/wp-content/uploads/2020/10/business-cash-advance-explained-300x157.jpg)